An alternative to consolidation is debt reduction, never to be baffled with federal debt forgiveness proposals utilizing the same name. Relatively, It can be when a company negotiates along with your creditors on your own behalf.

But this payment does not affect the knowledge we publish, or perhaps the testimonials you see on This web site. We don't incorporate the universe of organizations or money presents Which may be available to you.

Homeowners insurance policy guideHome insurance plan ratesHome coverage quotesBest house insurance coverage companiesHome insurance policies procedures and coverageHome insurance policies calculatorHome coverage critiques

This selection will make your financial institution a hassle-free and versatile way to borrow money. Having said that, yearly share rates (APRs) and loan terms may very well be a lot less favorable when compared with other lenders.

The mortgage interest deduction is often a tax incentive for homeownership. It lets some taxpayers generate off many of the interest charged by their dwelling loan. The deduction the moment was a staple of homeownership, nonetheless it has developed considerably less generous amid modifications into the legislation and an period of super-lower mortgage rates.

Luckily for us, there are a number of lenders and economic items that might be tailored to meet Anyone’s special borrowing requirements.

Her aim is on demystifying debt to help you men and women and business owners choose control of their finances. She has also been showcased by Investopedia, Los Angeles Periods, Cash.com and various fiscal publications.

Failing to repay a loan can have severe effects on your finances and credit. To begin with, you could be strike with late costs and an increase in your loan's interest rate. If nonpayment carries on, the lender may well ship your account to some collections agency, additional damaging your credit rating.

That said, personal loans are generally unsecured so borrowers need a credit rating of at least 610 or 640 to qualify. Nonetheless, applicants with Check out here greater scores will take advantage of a lot more favorable rates.

Choices to this drastic stage include refinancing the loan, trying to get enable from debt relief companies or credit counseling businesses, and immediately negotiating with creditors.

Several lenders assign a loan coordinator to guidebook you through the entire process of distributing your paperwork.

Collateral: Secured loans, like automobile loans or mortgages, require collateral as a method to guarantee repayment. The chance for the lender is decreased that has a secured loan due to the fact should you fail for making your loan payments, the lender can seize your asset to recoup their losses.

Existence insurance policies guideLife insurance policies ratesLife insurance policies policies and coverageLife insurance quotesLife coverage reviewsBest daily life insurance coverage companiesLife insurance calculator

Bankrate.com can be an unbiased, advertising-supported publisher and comparison services. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain hyperlinks posted on our website. Consequently, this compensation may impact how, where As well as in what get Additional info solutions show up in listing classes, besides exactly where prohibited by regulation for our mortgage, dwelling equity and various household lending merchandise.

Rick Moranis Then & Now!

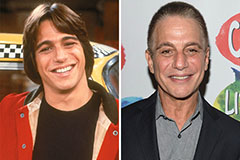

Rick Moranis Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Kane Then & Now!

Kane Then & Now!